Sooo, this is going to be my first financial post. My idea for this blog post is to walk you through my income, and some sort of general image of my expenses separated by category. The idea is to do a follow-up monthly as well as make separate posts about my goals and ambitions. I will also create a blog post going through my investment strategy.

My income and expenses

I currently work as a software developer, working both in front end and back end. I went back to working as a software developer after spending about 5-6 years working in different management positions including marketing and business unit manager. I had three main reasons for switching back to development.

- I was tired of being a manager. It could be very rewarding, but also hard at times and here the extra pay is quite small, so it was not worth staying for that reason.

- Since my long term plan is to be self-employed, the odds of that happening are bigger if I develop my skills in development rather than management.

- There are quite a few more positions open as developer compared to manager, and since I moved to a new city and was looking for a job, these three reasons combined made me decide to pursue development again.

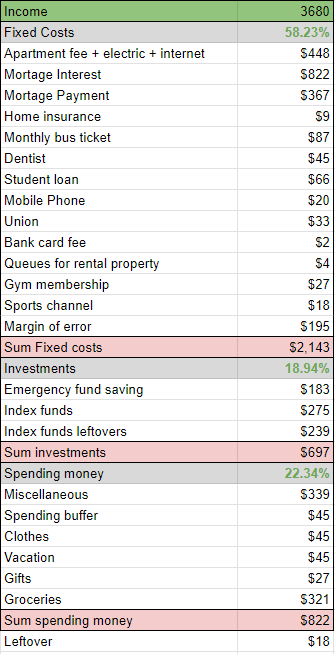

My current job pays me SEK 55 000 ($5 050) gross monthly. Which means SEK 40 110 ($3 680) net. And my budget that I’m trying to maintain looks as this (in USD):

My comments

Firstly let me explain this:

The margin of error under Fixed Costs is a 10% margin that I add to account for unexpected expenses. My idea is to yearly see how much money is on my billing account and invest part of it in case it has accumulated too much money.

The “Index funds leftovers” under Investments are a feature my bank offers to transfer “whatever is left in the account” at a certain date. My idea behind this is that whilst my salary is about $3 680 working full-time, it might not be my actual payout, in case I was sick or something. This way I don’t have to manually handle it, but know that whatever I can save after I transferred money to my spending and my billing account will be invested.

The spending money categories are just my idea of what sounds reasonable, this is however not the reality. My idea is to save for example $27 monthly for gifts, since we all know Christmas and other gift-giving events come up every year. So it’s basically a way of evening out the monthly costs. My vacation savings are also a bit low. Since I usually get money back doing my taxes, I usually take that, or part of that, as my vacation budget for the summer.

I should also add that it’s been about a month since I set this budget, so I’m still trying to get acquainted with it.

Hope you all have a good night, day, morning or whatever it is for you when you’re reading this 🙂